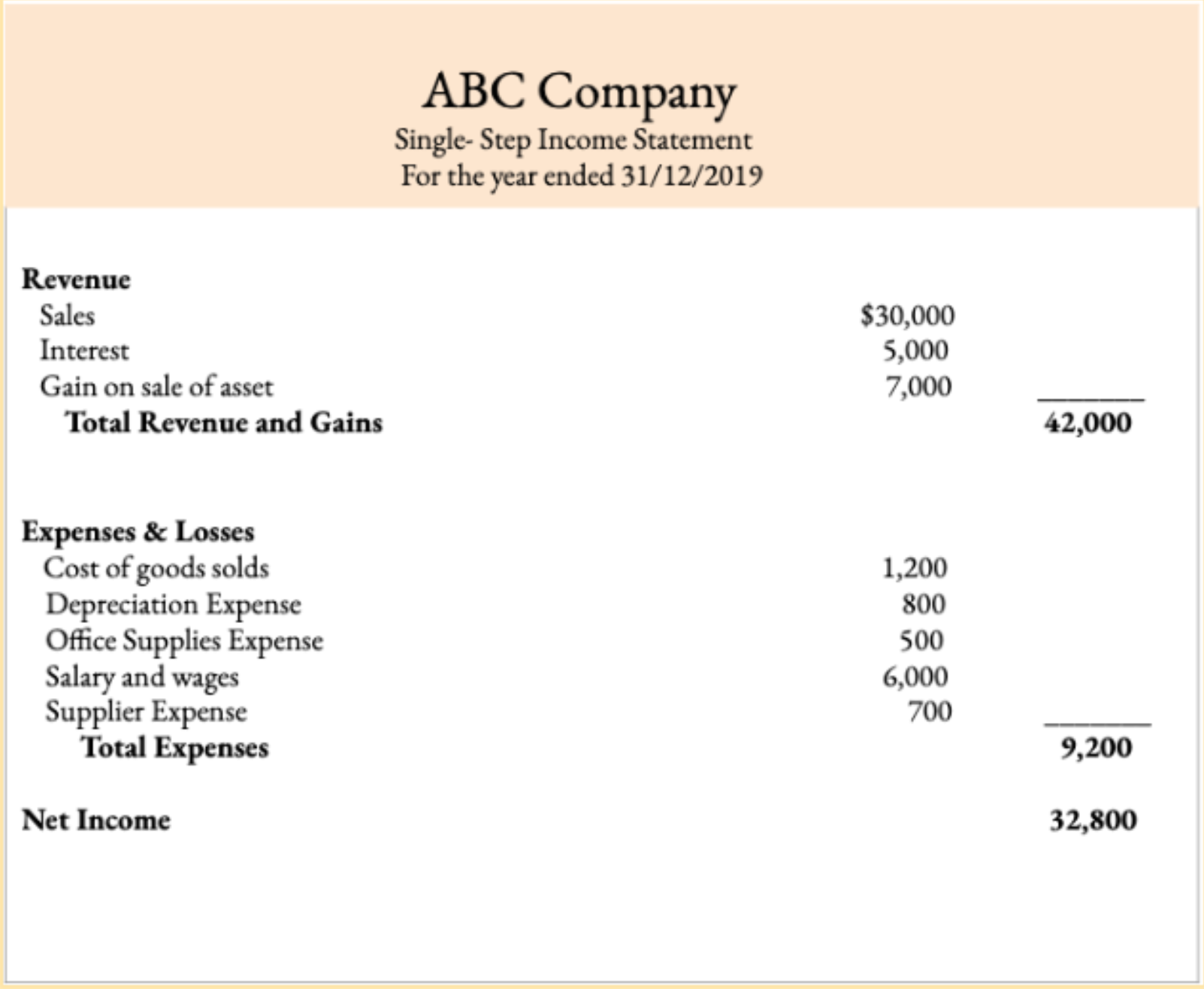

Cost of Goods Sold Is Computed From the Following Equation

Net income or loss under single entry bookkeeping is computed using an approach that directly matches cost with revenue. Calculate ending inventory cost of goods sold and gross profit for 2018 assuming the company uses LIFO with a periodic inventory system.

What Is Cost Of Goods Sold Cogs Definition Calculation Examples

After the expiry of the life of the asset the asset becomes useless and the full value has to be written off.

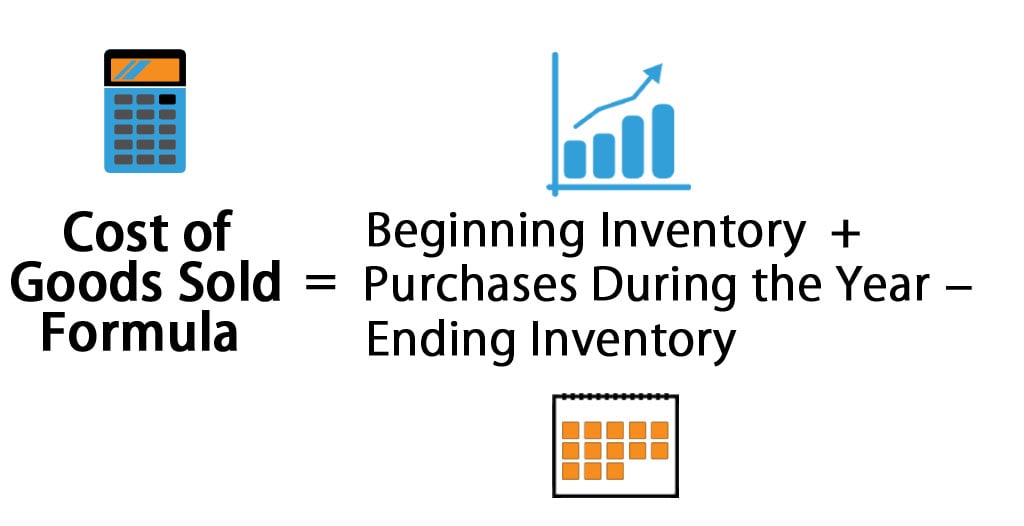

. Choose the correct statements. The value of opening stock or work-in-process is added to the cost incurred in the current accounting period and the total cost is divided by the total number of completed units in order to arrive at the average cost of equivalent units. Calculate ending inventory cost of goods sold and gross profit for 2018.

Merchandise inventory account is not recognized under single-entry bookkeeping II. The following statements relates to the double-entry system and the single-entry system. Explain the effects in the companys.

In cost accounts depreciation of an asset is charged to cost of sales on the following grounds. To comply with IFRS the company decides to instead account for inventory using FIFO. It represents a charge for the use of capital resources.

653 Following two points should be kept in mind while following the average cost method inventory costing. If depreciation is provided sufficient. This is against business practice.

Cost Of Goods Sold Formula Calculator Excel Template

What Is Cost Of Goods Sold Cogs Definition Calculation Examples

Cost Of Goods Sold Definition Cogs Formula More Patriot Software

No comments for "Cost of Goods Sold Is Computed From the Following Equation"

Post a Comment